Taxes title license calculator

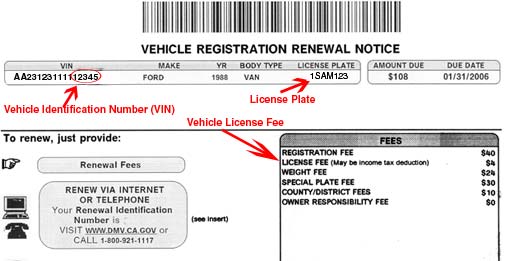

Tax Season Vehicle License Fee VLF paid for tax purposes Select a Calculator to Begin Registration renewal fees Registration fees for new vehicles that will be purchased in. In the Northern Virginia region the.

Car Tax By State Usa Manual Car Sales Tax Calculator

The tax rate for most vehicles is 457 per 100 of assessed value.

. For the sales tax of both new and used vehicles to be paid it is calculated by multiplying the cost of buying the car by 625. The sales tax on both new and used vehicles is calculated by multiplying the cost of the vehicle by 625 percentage. For properties included in a special subclass the tax rate is 001 per 100 of assessed.

In Texas the title fee is 33 in most of the counties. Motor Vehicle Trailer ATV and Watercraft Tax Calculator The Department collects taxes when an applicant applies for title on a motor vehicle trailer all-terrain vehicle boat or outboard motor. Use this information and data to help decide.

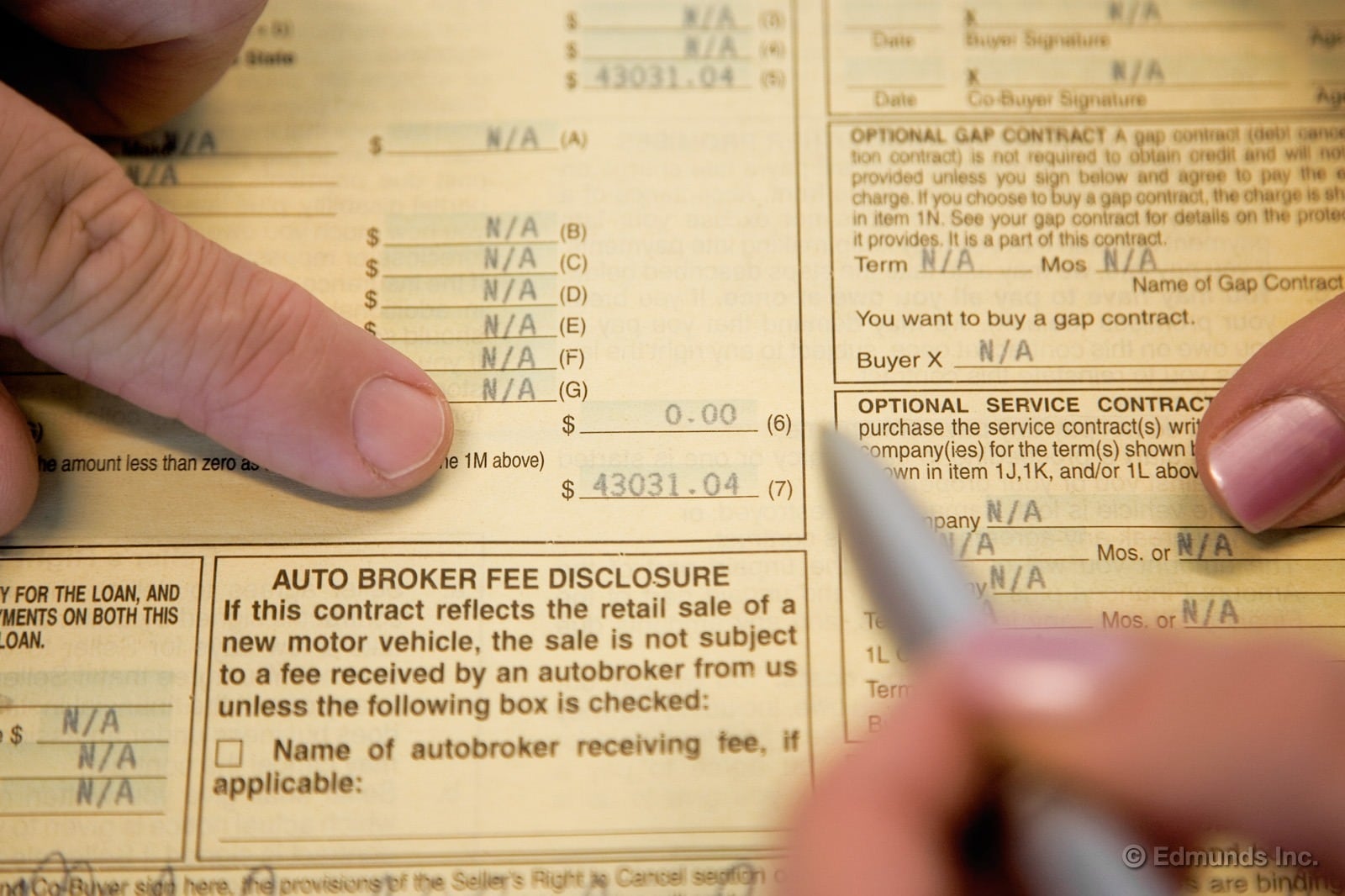

The car title loan calculator provides a quick and easy way to compute any loan amount monthly payment interest rate and full payment schedule. Multiply the vehicle price after trade-in andor incentives by the sales tax fee. The cost is one percent or 1001000 of the transaction amount.

Object Moved This document may be found here. How to Calculate Kentucky Sales Tax on a Car. For the sales tax of both new and used vehicles to be paid it is calculated by multiplying the cost of buying the car by 625.

Shop Cars By Price. The home seller typically pays the state transfer tax called the grantors tax. In Texas the title fee is 33 in most of the counties.

Under 15000 Under 20000. In most counties in Texas the title fee is around 33. Estimated tax title and fees are 1000 Monthly payment is 405 Term Length is 72 months and APR is 8.

New Mexico Title Only. To calculate the sales tax on your vehicle find the total sales tax fee for the city. The minimum is 625 in Texas.

Title. Remember that the total amount you pay for a car out the door price not only includes sales tax but also registration and dealership fees. Vehicle Personal Property Tax.

Texans who buy a used vehicle from anyone other than a licensed vehicle dealer are required to pay motor vehicle sales tax of 625 percent on the purchase price.

Calculate Your Transfer Fee Credit Iowa Tax And Tags

.png)

Maximizing Tax Deductions For The Business Use Of Your Car Turbotax Tax Tips Videos

Dmv Fees By State Usa Manual Car Registration Calculator

Massachusetts Used Car Sales Tax Fees

Florida Vehicle Sales Tax Fees Calculator

How To Calculate Tax Title And License In Texas Calculating Taxes On Newly Bought Cars

California Vehicle Sales Tax Fees Calculator

Get The Out The Door Price When Buying A Car Calculate Tax Title And Registration Edmunds

Find Out If You Have To Pay Import Tax When Shipping A Car To The Usa And How Much It Costs As Well As Information On Exemptions Gas Guzzler Tax And More

A Primer On The Vehicle License Fee

Calculate Your Transfer Fee Credit Iowa Tax And Tags

Car Tax By State Usa Manual Car Sales Tax Calculator

Bh Series Vehicle Registration Online Apply Process Link And Cost Of Bharat Series Registration Only 30 Second

Property Tax Calculator

Vehicle Registration Licensing Fee Calculators California Dmv

Texas Vehicle Sales Tax Fees Calculator Find The Best Car Price

Oklahoma Vehicle Sales Tax Fees Calculator Find The Best Car Price