Net present value of annuity

Finds the present value PV of future cash flows that start at the end or beginning of the first period. Ad 11 Tips You Absolutely Must Know About Annuities Before Buying.

Annuity Present Value Pv Formula And Calculator Excel Template

Loan rental payment regular deposit to saving.

. Project A requires an investment of 1 mn which will give a return of 300000 each. General Electric has the opportunity to invest in 2 projects. Present value PV is the current worth of a future sum of money or stream of cash flows given a specified rate of return.

The idea behind present value is that money you receive today is worth more than the same amount of money if you were to. PV FV 11 i n. Once we sum our cash flows we get the NPV of the.

Annuity Payment - Future Value FV Calculator. Should the equipment be purchased according to NPV analysis. Why is a NPV calculation useful.

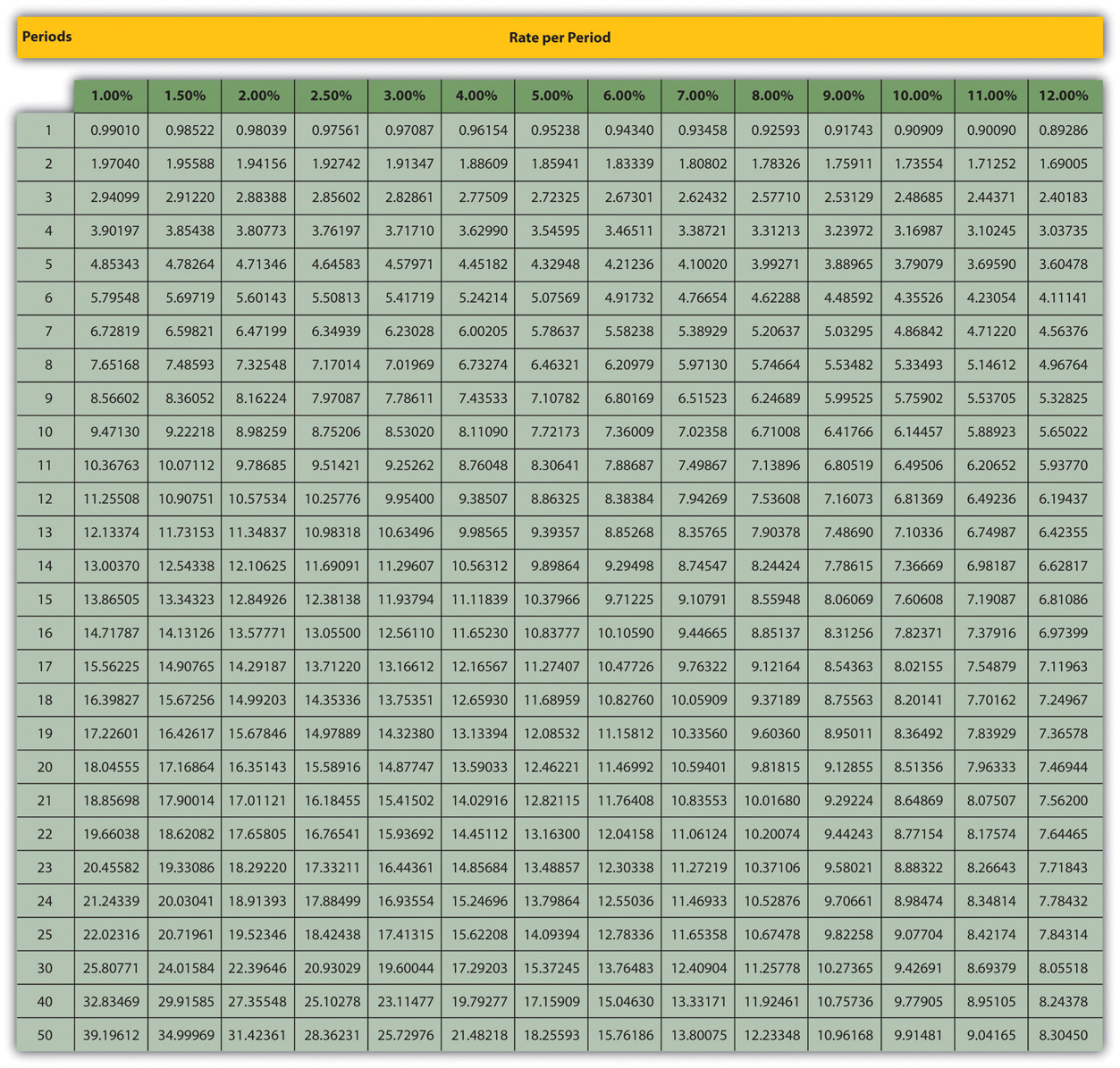

For example an individual is wanting to calculate the present value of a series of 500 annual payments for 5 years based on a 5 rate. Rate Per Period As with. Annuity Due Payment - Future Value FV Calculator.

Learn some startling facts. Net present value NPV lets you know whether the value of all cash flows that a project generates will exceed. 1 Computation of net present.

Present Value - PV. Future cash flows are. By putting the values of n and i into the present value of a single sum formula.

Present value of an annuity is finance jargon meaning present value with a cash flow. NPV Net Present Value Formula Example 2. Use Our Calculator To Get a Free Estimate of The Value of Your Life Insurance Policy.

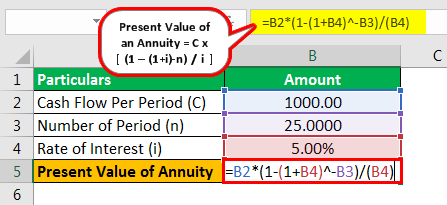

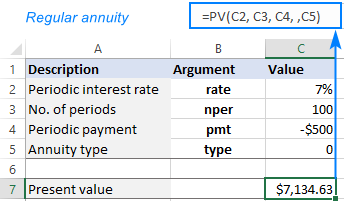

Pmt - the value from cell C6 100000. In insurance an actuarial reserve is a reserve set aside for future insurance liabilities. Annuity Due Payment - Present Value PV Calculator.

Ad Get this must-read guide if you are considering investing in annuities. Once we calculate the present value of each cash flow we can simply sum them since each cash flow is time-adjusted to the present day. Dont Buy An Annuity Until You Review Our Top Picks For 2022.

11 Little-Know Tips You Must Know Before Buying. To calculate the PV of the. Unlike the IRR or MIRR calculations that express results in percentage terms the NVP calculation reveals its results in.

Rate - the value from cell C7 7. Type - 0 payment at end of period regular annuity. NPV Present value of Inflows Present value of outflows.

Present Value or PV is defined as the value in the present of a sum of money in contrast to a different value it will have in the future due to it being invested and compound at. The present value is simply the value of. Calculate the net present value of uneven or even cash flows.

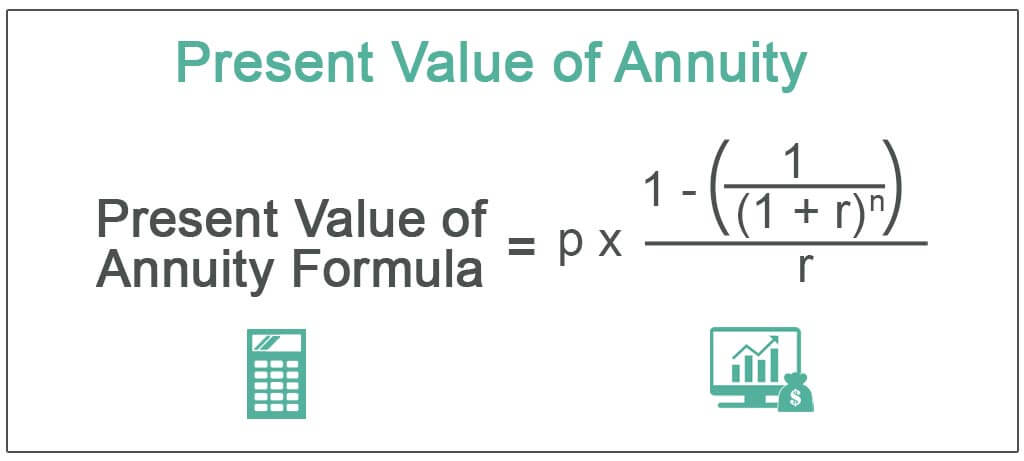

Why use a net present value calculator. The net impact of these two forces will determine if your future value rises or falls relative to the present value today. The present value of annuity formula relies on the concept of time value of money in that one dollar present day is worth more than that same dollar at a future date.

Calculating the present value of an annuity due is basically discounting of future. The cash flow may be an investment payment or savings cash flow or it may be an income cash flow. Ad 11 Tips You Absolutely Must Know About Annuities Before Buying.

Ad Find Out Now What Your Life Insurance Policy Could Be Worth With Our Free Calculator. The amount of 5000 to be received after four years has a. Compute net present value NPV of this investment project.

How to Figure Out the Present Value of a Future Sum of Money. It is generally equal to the actuarial present value of the future cash flows of a contingent event. Step 4 To arrive at the PV of the perpetuity divide the cash flows with the resulting value determined in step 3.

Calculate the present value of an annuity due ordinary annuity growing annuities and annuities in perpetuity with optional compounding and payment frequency. Nper - the value from cell C8 25. Step 3 Next determine the discount rate.

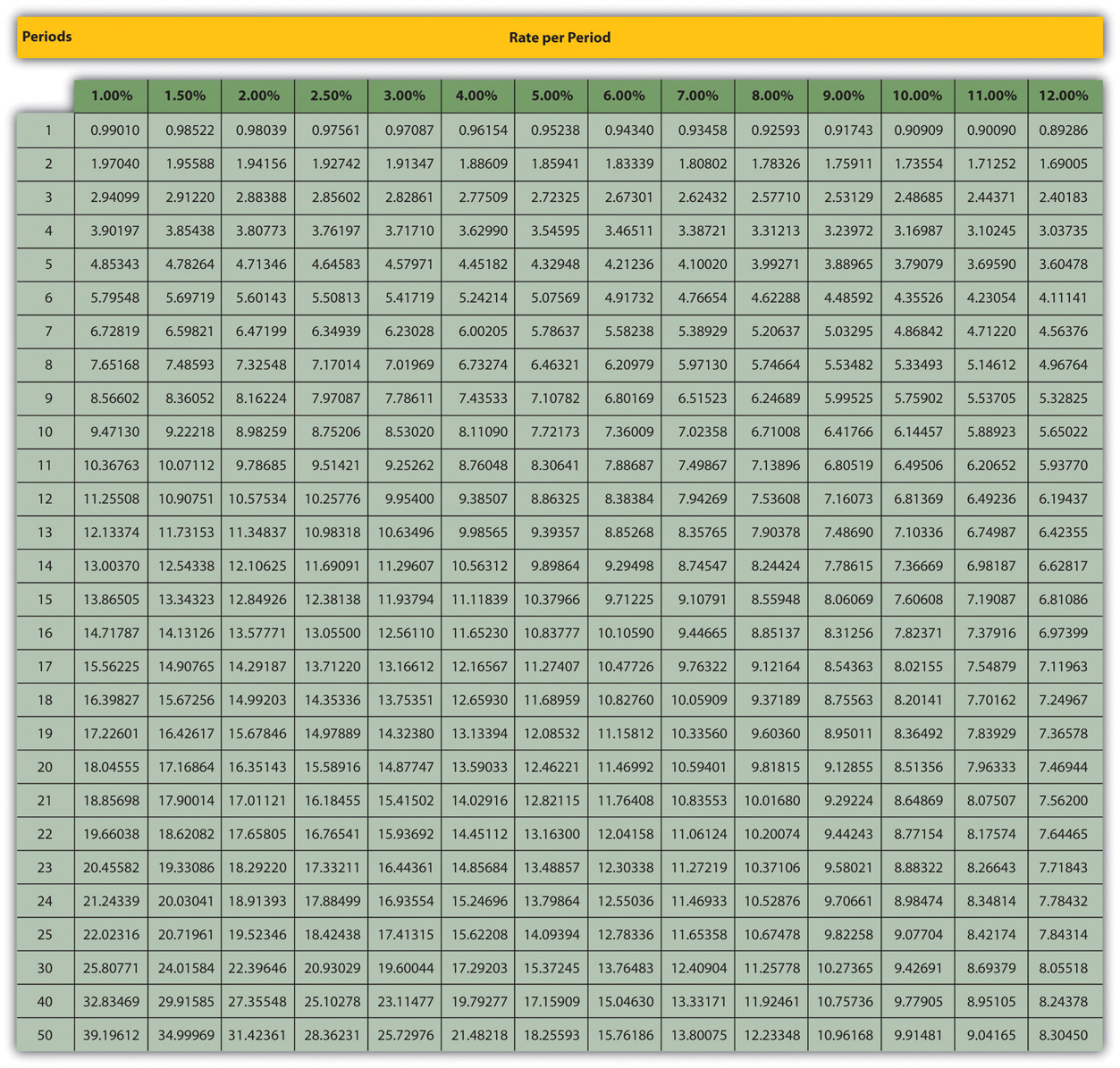

PV of Annuity Due 500 1 1 1 1212 12 1 12 PV of Annuity Due Explanation. An annuity is a series of equal payments or receipts that occur at evenly spaced intervals. By looking at a present value annuity factor table the.

Annuities are often complex retirement investment products.

Present Value Of An Annuity How To Calculate Examples

Present Value Of Perpetuity How To Calculate It Examples

Present Value Of Annuity Formula Calculate Pv Of An Annuity

Present Value Of Annuity Formula Calculate Pv Of An Annuity

1 Present Value Annuity Formula Download Scientific Diagram

How To Calculate The Present Value Of An Annuity Youtube

Present Value Of An Annuity Definition Interpretation

What Is An Annuity Table And How Do You Use One

Present Value Pv Of An Ordinary Annuity Formula With Examples Time Value Of Money Youtube

Annuity Present Value Pv Formula And Calculator Excel Template

Present Value Of An Annuity How To Calculate Examples

Using Pv Function In Excel To Calculate Present Value

Present Value Of A Growing Annuity Formula With Calculator

Present Value Of Annuity Formula With Calculator

Present Value Of Annuity Due Formula Calculator With Excel Template

Excel Formula Present Value Of Annuity Exceljet

Appendix Present Value Tables Financial Accounting